CommSec

CommSec

13 Sep 2023

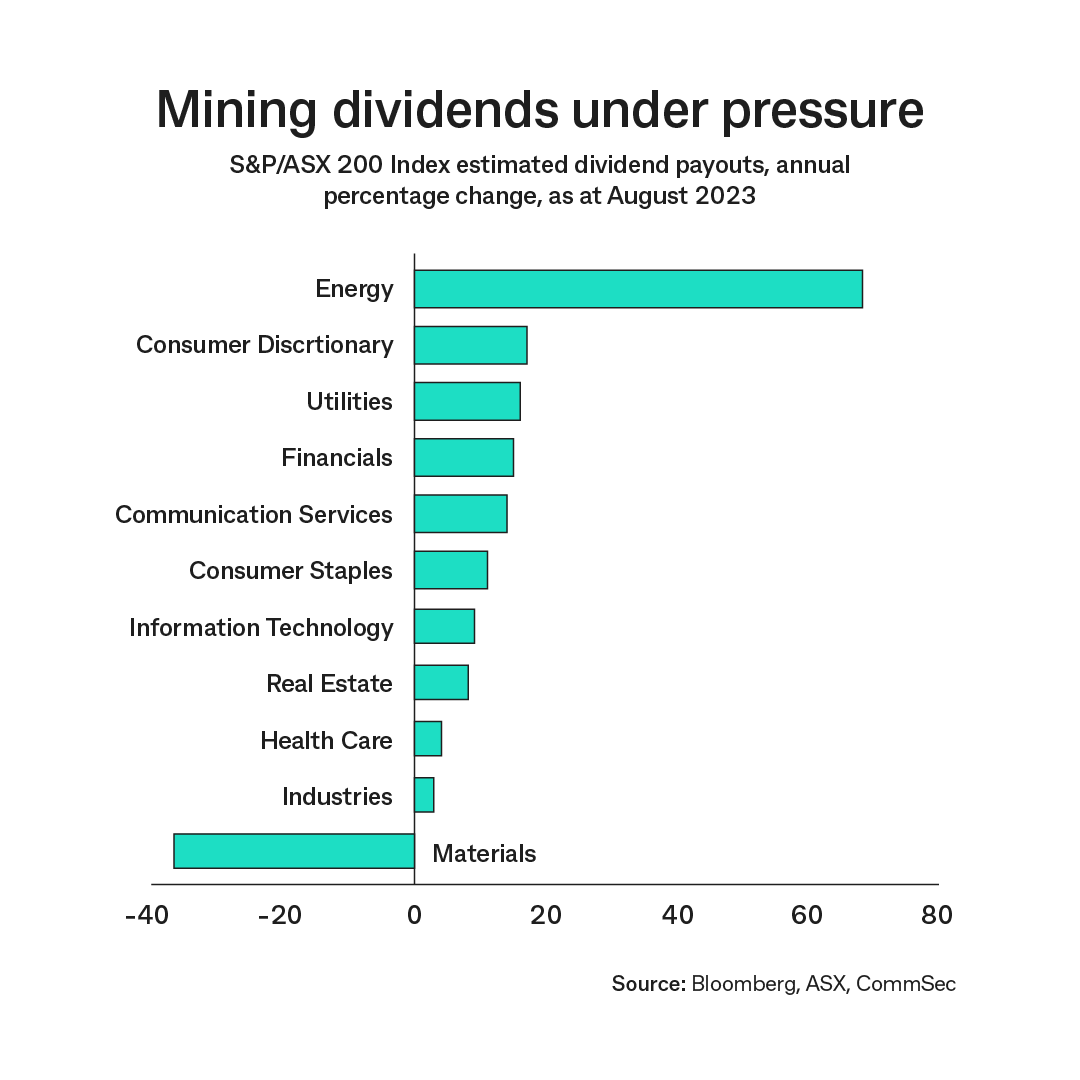

- Major miners cut dividends, while financials pay out more to shareholders.

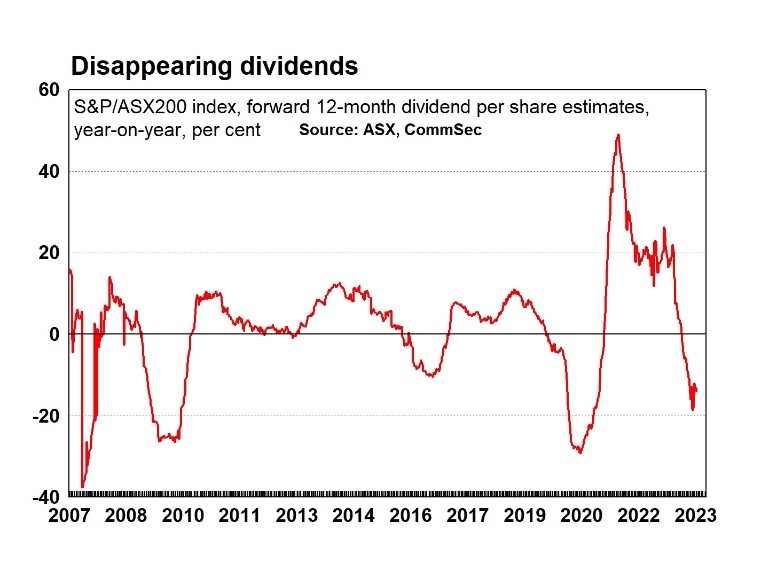

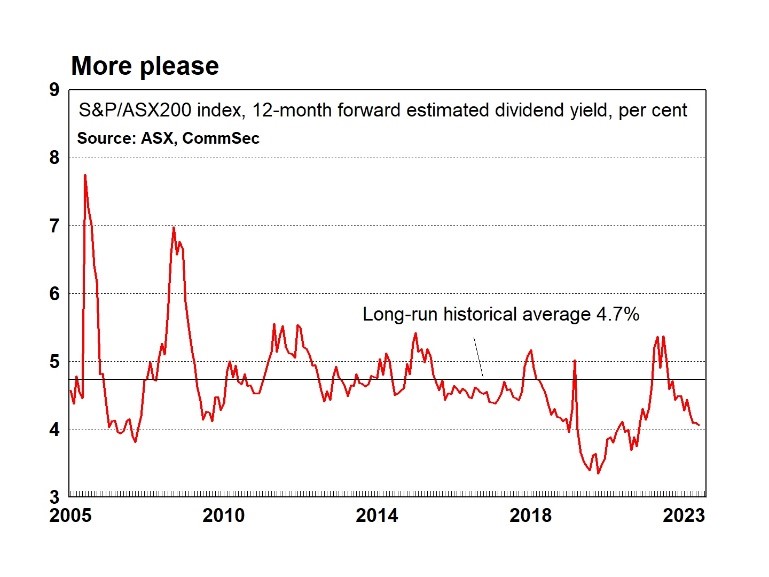

- Analysts cut dividend payout estimates at a pace not seen since 2009 (outside of Covid-19 period). In fact, forward 12-month dividend per share estimates have been cut by 14 per cent year-over-year to September 6, 2023. The 12-month forward estimated dividend yield for the S&P/ASX 200 index is currently 4.06 per cent, below the long-run average near 4.7 per cent since 2005.

- The average dividend payout ratio on the index is near decade lows at 62 per cent compared with 72 per cent prior to the Covid-19 pandemic, according to Bloomberg estimates.

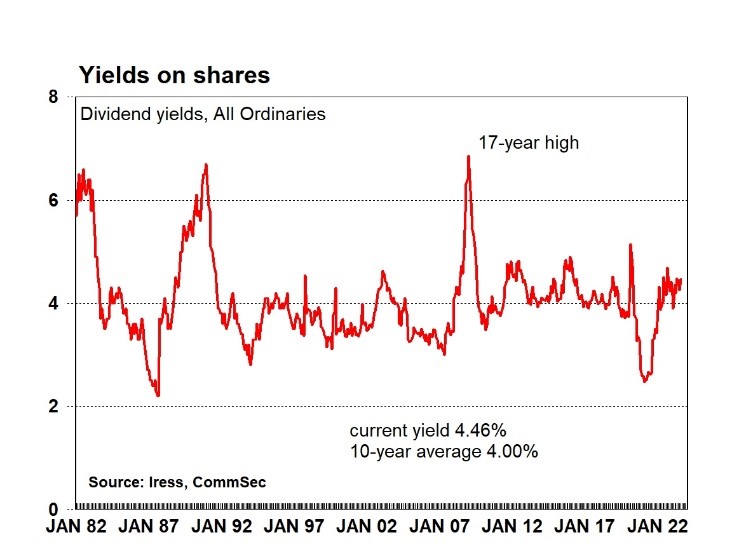

- Returns on Aussie shares remain attractive versus bank deposits, bonds and overseas shares with grossed-up dividend yields of around 5.7 per cent. For the S&P/ASX 200 index, the historic dividend yield stands at 4.5 per cent, above the decade-average of 4.07%.

The importance of dividends

Since the Global Financial Crisis the importance of dividends has grown due to the larger role they now play when it comes to total returns.

There are a few reasons for this.

The economy has continued to mature and the “potential” growth rate has eased from around 3.5 per cent to 2.3 per cent.

Many of Australia’s biggest companies operate in mature industries like banks, retailing, health and real estate investment trusts rather than “growth” industries such as technology. So while many companies continue to make money, growth options are more limited.

Over time, Australian companies have to compete with property markets, the security of bank deposits and overseas equities to gain the affection of investors. With share prices seemingly constrained by a range of influences, that puts more onus on companies to offer attractive dividends or to support share prices with buybacks.

Despite the current uncertain environment, around 87 per cent of ASX 200 companies have elected to pay dividends but a higher proportion have reduced payouts compared with a year ago.

Some companies have been paying out more in wages (employing more staff at a higher cost), purchasing new equipment and facing challenges in operating conditions.

The August 2023 Earnings Season

Understandably companies have to take current and prospective conditions into account when deciding on what dividends to pay. Faced with rising costs, slowing consumer demand and a weakening Chinese economy, companies lowered their dividends in the recent reporting season. And that is especially the case of the large iron ore producers in the latest round of earnings. Profits are down over the past year reflecting lower realised iron ore prices. And the outlook continues to suggest that lower iron ore prices lie ahead.

As a result, the big iron ore miners are trimming dividends. It’s worth emphasising that dividends are still historically high, but they are lower than a year ago. In the case of BHP, the upcoming payout of A$6.3 billion is down 51 per cent on a year ago after the mining giant slashed its interim dividend by 40 per cent as earnings fell. In Australian dollar terms, Rio Tinto (RIO) will trim payouts by 32 per cent after slashing its interim dividend by 34 per cent compared with a year ago. Fortescue will issue a dividend around 14 per cent lower than a year ago.

Energy producers aren’t applying a uniform strategy on dividends, reflecting differences in oil, gas and thermal coal prices. Woodside Energy (WDS) will cut its interim dividend by 22 per cent (in $A terms). But Santos (STO) will increase payouts to shareholders by 24 per cent. And Whitehaven Coal (WHC) will lift payouts by 5 per cent.

Financial firms generally are lifting dividends including Commonwealth Bank (CBA, up 14 per cent, annual dividend 17 per cent higher); Bendigo & Adelaide Bank (BEN, up 21 per cent); Suncorp (SUN, up 59 per cent); QBE (QBE, up 56 per cent).Of the major supermarkets Woolworths (WOW) will lift dividends around 9 per cent, while Coles (COL) will leave its dividend unchanged. Analysts note that Woolworths is doing better on controlling costs.

Qantas (QAN) again chose not to declare a dividend rather choosing the route of a buyback to seek to boost returns for shareholders. Overall, Ausbil analysis shows that over half of the Aussie market’s combined dividends come from eight companies, including ANZ, BHP, Commonwealth Bank, Fortescue Metals, NAB, Rio Tinto, Westpac and Woodside Energy. That is, the earnings performance and capital expenditures of these “Great Eight” will largely determine overall dividend payouts this financial year.

Outlook

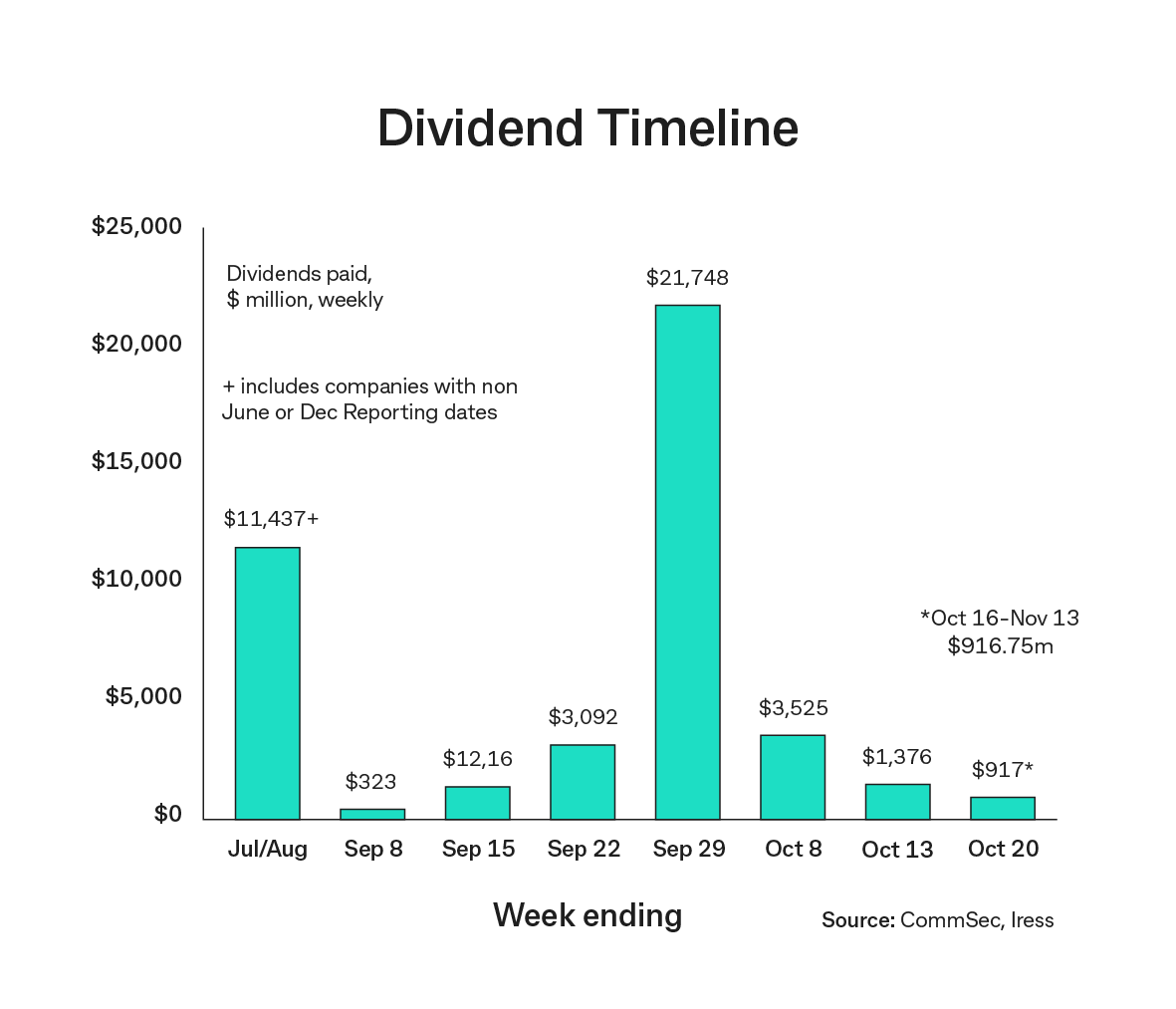

Investors have the usual choice over the next few weeks. Those investors that still elect to receive dividend payments direct to their bank accounts can choose to spend the extra proceeds, save the proceeds (leave it in the bank) or use the funds in combination with other savings and reinvest into shares or other investments.

With the cost of living rising together with interest rates, some investors may use dividends to maintain their standard of living or meet higher loan repayments.

Of course there always are those investors that see longer-term opportunities – especially given recent volatility – choosing to channel the dividends into sharemarket purchases. The performance of investment returns over time when dividends are included in the calculation is especially emboldening – that old saying that ‘it is time in the market that is important rather than timing the market’.

From an investor perspective, dividend payouts are incredibly important. Regular income payments to investors can cushion portfolios from the bouts of volatility in sharemarkets, preserving capital. And the extra cash put ‘back to work’ in the sharemarket could help stabilise or even support the ASX during the current bout of volatility.

The big issue over the next six months is the consumer response to the higher cost of living and sharply higher interest rates, adding to borrowing costs. Tight job markets may also ease on the assumption that businesses will have less scope to pass on cost increases to consumers and will need to trim costs.

There is much uncertainty about how consumers respond to high costs and softer job markets. Some consumers are still sitting on healthy savings generated in the Covid period. In contrast the balance sheets of other consumers have been tightened so that active attempts are being made to trim non-essential spending.

Companies have been mindful of the challenging times ahead when setting strategies on dividends or buybacks. But they also have had to be mindful that savers have more choice with interest rates at higher levels.

Still, Investors will need to focus carefully on the strategies applied by companies. While investors may embrace higher dividends in these uncertain times, they also need to assess whether that strategy is the best one to employ in a medium-term sense. No use in lifting dividends if it puts pressure on cash and profits levels. Already aggregate annual earnings per share (EPS) growth estimates have been revised down to a 6.2 per cent fall in Financial Year 2024, implying lower dividends as companies return less earnings.

Back to

Back to