CommSec

CommSec

10 Sep 2024

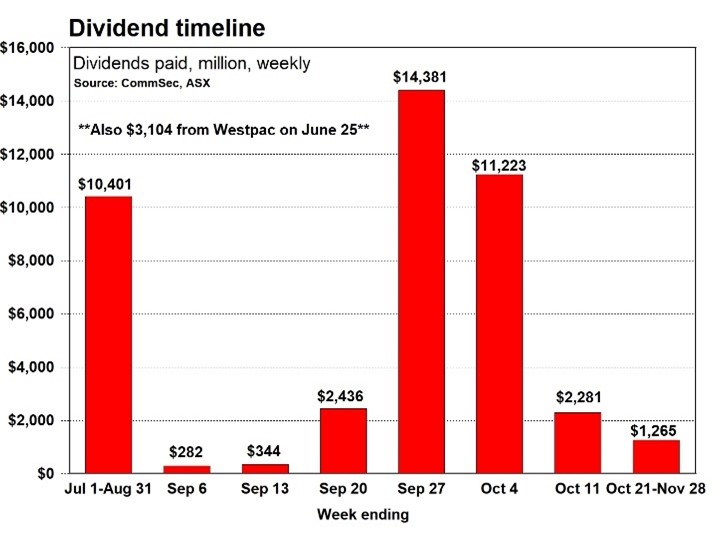

Just under $35 billion of dividends have been, or will be, paid to investors between August and October 2024, up 5 per cent on a year ago. If you include dividends by major banks in late June and early July, dividends were up around 7 per cent on a year ago to $45 billion. Key highlights include:

- Aussie companies are expected to pay out over $80 billion in dividends for Financial Year 2024, up around 5 per cent from the previous fiscal year.

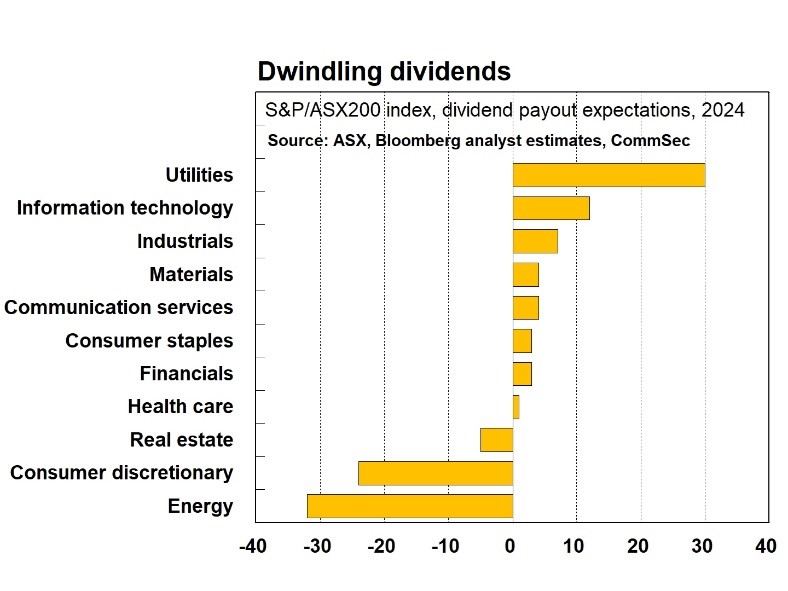

- Major miners again cut dividends, while financials (banks and insurers) pay out more to shareholders.

- Banks’ 12-month forward dividend yields stand-out across S&P/ASX 200 index sectors at 4.2 per cent, particularly when the 1.8 per cent franking benefit is added. Similarly, telecommunications stocks have a 4.5 per cent 12-month forward dividend yield, plus a 1.8 per cent franking benefit.

- The pace of analyst cuts to dividend payout estimates eased in the August corporate reporting season. In fact, forward 12-month dividend per share estimates have been cut by just 0.6 per cent year-over-year to September 9, 2024. Whereas in 2023, the 14 per cent cut in analyst payout estimates was the biggest since 2009 outside of the Covid-19 pandemic period.

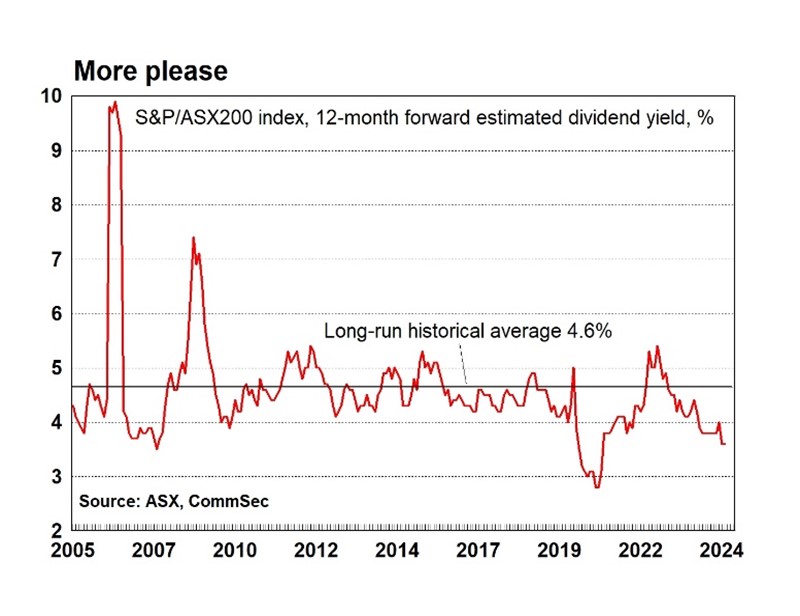

- The 12-month forward estimated dividend yield for the S&P/ASX 200 index is currently 3.6 per cent, below the long-run average near 4.5 per cent since 2000.

- The average dividend payout ratio on the index – the percentage of net income paid out to shareholders as dividends – has risen from near decade lows at 56 per cent in calendar year 2022 to 73 per cent in calendar year 2023, near the long-run average prior to the Covid-19 pandemic.

- Returns on Aussie shares remain attractive versus bank deposits, bonds and overseas shares with grossed-up dividend yields of around 4.9 per cent but are below the decade average of 5.7 per cent.

- Analysts’ dividend forecasts for Australia have tracked sideways in 2024, with the S&P/ASX 200 blended forward 12-month estimated dividend per share (DPS) at 43.3 per cent on September 9, 2024, down from 47.2 per cent at the beginning of the year.

- In terms of individual company dividends, the Commonwealth Bank (CBA) announced a record dividend at $2.50 a share, fully franked, to take dividends to $4.65 a share over the fiscal year, up 4.2 per cent from last year. The CBA will pay $4.18 billion in dividends, the second top payer after BHP. It is worth noting that while the “Big Four” dividends appear to be sustainable, they have been compressed to below-average levels, with the 12-month forward dividend yield for ANZ, CBA, NAB and Westpac at 4.3 per cent, which is below the long-run average of 5.7 per cent since 1997.

- In a sign of resilience in the consumer-facing sectors, electronics retailer JB Hi-Fi announced a special dividend of 80 cents per share fully franked. Conglomerate Wesfarmers – owner of Kmart, Bunnings and Officeworks - declared a fully franked final dividend of $1.07 a share, bringing the total to $1.98, which was up 3.7 per cent. Wesfarmers will pay out a total of $1.21 billion in dividends. Grocery giant Woolworths declared a final dividend of 57 cents per share, along with a special dividend of 40 cents apiece, taking its total payout to $1.18 billion.

- Elsewhere, telecommunications giant Telstra will pay a dividend of 9 cents per share on September 26, bringing its total dividend for the year to 18 cents a share, with a $1.04 billion total payout to investors. The payment will take the dividend yield to 4.5 per cent, which is in-line with the average for the industry. Blood products giant CSL lifted its interim dividend to $US1.19 per share, up from $US1.07 in the previous year. At 220.2 Australian cents per share the total payments equate to around $1.06 billion.

- It was a particularly strong reporting season for Aussie-listed insurers with Insurance Australia Group (IAG) rewarding investors with a higher full-year dividend, 27 cents per share, up from 15 cents per share. Also, Suncorp increased its payout by 63 per cent after it announced plans to pay a fully franked final ordinary dividend of 44 cents per share. Medibank super-sized its dividend, declaring a record final dividend of 9.4 cents per share for 2024, up by 13.3 per cent from 2023.

- It was a mixed reporting season for mining and energy companies. BHP, Fortescue and Woodside Energy were three of the top four biggest dividend payers across resources in the August 2024 reporting season, but they paid $1.5 billion less in aggregate than the same period last year.

- BHP continued to pay the most dividends at $5.54 billion but it cut its final dividend by almost 10 per cent to fund growth in its potash and copper mining projects. The miner’s full-year dividend of $US1.46 represented 54 per cent of its underlying earnings – the lowest payout ratio since BHP reset its dividend policy in 2016. The final dividend comes to A$1.09 a share, fully franked. Weaker-than-expected production guidance in Financial Year 2025 is also expected to weigh on BHP’s dividend outlook.

- Fortescue announced a final dividend of 89 cents a share, taking its full-year dividend to $1.97 a share, representing a payout ratio of 70 per cent, above last year’s 65 per cent ratio. That said, it reduced its final dividend by 12 per cent due to lower iron ore prices. It still paid out $2.74 billion to investors.x

- Woodside Energy decided on a fully franked interim dividend of 69 US cents per share, which is currently approximately A$1.02 per share. The dividend is 13.8 per cent lower than the Financial Year 2023 first-half payment but 15 per cent higher than the FY23 final dividend as it increases spending in oil and gas fields.

- In terms of the outlook among locally listed stocks, dividend payouts are expected to ease around 2 per cent compared to the prior year. Even though most sectors could increase payments, led by utilities, dividend cuts will likely be led by the energy and consumer discretionary sectors.

Back to

Back to